The role of economic indicators in evaluation IOTA (IOTA)

Cryptomena, such as Bitcoins and Ethereum, have gained considerable attention in recent years because of their potential of the revolution in the way we are considering money and financial transactions. One of the cryptocurrencies that has gained traction is Iota (Flow), a decentralized distributed book technology developed by Charles Hoskinson. In this article, we will examine the role of economic indicators in the evaluation of IOTA and examine its current market situation, technical analysis and potential future development.

What is iota?

IOTA is a Peer-to-peer network that allows fast and secure data transfer between devices without the need for intermediaries. To verify transactions and ensure network integrity, it uses a consensus algorithm in the field of work. Native Iota cryptocurrency, TCO, can be used to pay goods and services within the IOTA ecosystem.

Economic indicators: IOTA Key to evaluate

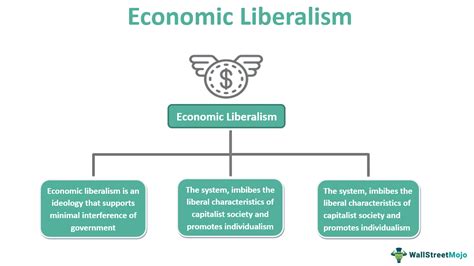

In evaluating active assets, including a cryptomen, such as IOTA, they play an essential role in determining its value. These indicators provide a view of the health of the economy, the levels of inflation, the interest rates and other macroeconomic factors that may affect the price of the asset.

Here are a few key economic indicators that we will review in IOTA:

1 The relatively low Iota inflation rate (around 0%) is more attractive to investors.

- Interest rates : Low interest rates can encourage people and businesses to invest in assets such as cryptocurrencies, increase demand and prices. On the contrary, high interest rates can reduce investments in cryptocurrencies, leading to lower prices.

3 On the contrary, the poor growth rate of GDP can lead to higher inflation and a reduction in asset values.

4.

Technical Analysis: Iota graph patterns

Technical analysis is a method of evaluating the performance of financial instruments based on their price movements over time. Iota has reported several graph patterns in recent months that indicate its potential for long -term growth:

1.

- Support and Resistance : The current level of support is around $ 3.50, while resistance levels are $ 4.00 and $ 5.00. A break above the upper resistance level could lead to a significant increase in prices.

3.

potential future development

Looking into the future, there is some potential future development for IOTA:

1.

- Partnerships and Integration

: Cooperation between IOTA and other companies or organizations could expand its user base and increase its value proposal.

- Regulatory uncertainty : changes in regulatory environments, such as the introduction of new washing regulations (AML), could affect the acceptance and prices of IOTA.

Conclusion

Finally, economic indicators play a decisive role in evaluating the potential of IOTA for growth. Low inflation rate, interest rates, GDP growth rate and unemployment rate support the idea that Iota is a relatively stable and attractive investment opportunity.