Title: Mastering the art of cryptocurrency trading from Stellar (XLM)

Entry

The world of cryptocurrency has exploded in recent years, and new investors enter the market every day. With the increase in blockchain technology and decentralized networks, cryptocurrencies such as Stellar (XLM) have gained significant adhesion. In this article, we will delve into the world of commercial strategies for star investments and provide a comprehensive guide on making informed decisions.

What is cryptocurrency?

Cryptocurrencies are digital or virtual currencies that use cryptography for security and are decentralized, which means that they are not controlled by any government or financial institution. Examples of popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC). Stellar (XLM) is a peer-to-peer network that allows quick and cheap cross-border payments.

Stellar investment review (XLM)

Stellar is an open, decentralized public network for creating and exchanging digital assets. It is designed to facilitate safe, efficient and cheap transactions between sides over long distances. Thanks to his innovative technology, Stellar has gained the attention of investors looking for stable and lucrative investment capabilities.

Trade strategies for Stellar (XLM) investments

To effectively mention cryptocurrencies, such as XLM, you need to develop understanding of trade strategies that take into account the special features of each resource. Here are some strategies to consider:

1.

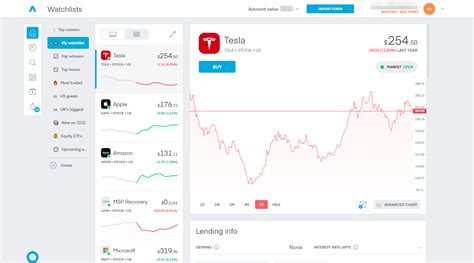

Technical analysis

Technical analysis includes the study of charts and patterns to identify trends, support and resistance levels and other market indicators. Analyzing these tools, traders can make informed decisions regarding the purchase or sale of XLM.

- Identify key levels: look for significant price movements and potential purchase/sale points.

- Use technical indicators: use indicators such as moving medium (MA), relative force indicator (RSI) and Bollinger bandwidth to confirm trends.

- Analyze chart patterns: study candle patterns such as absorbing or bear patterns.

2.

Basic analysis

The basic analysis includes the assessment of the economic and market bases of cryptocurrencies, such as the case of use, adoption indicators and programmers’ activity.

- Examine the project: Understand the goal, tokenomics and road map.

- Analyze market trends: look at historical price data, market moods and global economic conditions.

- Rate the potential risk: Consider factors such as regulatory changes, safety concerns and competition on the market.

3.

Risk management

Risk management is necessary during cryptocurrency trading. This includes establishing clear expectations for potential losses and restrictions for your commercial activity.

- Set the Stop-Loss levels: Specify the predetermined price level at which you will sell XLM if it falls below.

- Use the item

- Monitoring capacity: keep checking your transactions, including victory, losses and profitability.

4.

Averaction of dollar costs

Averaging costs in dollars consists in investing a fixed amount at regular intervals, regardless of the market results. This strategy helps smooth market fluctuations and reduces the impact of time risk.

- Automatize your transactions: configure automated trading systems to invest part of your portfolio in a regular schedule.

- Monitor your progress: Follow your investments and adjust the strategy if necessary.

5.

Stellar (xlm) coin

The coin refers to the process of buying or selling XLM using other currencies, such as USD. Understanding how to convert between different currencies can help optimize transactions.